madrid

Vacancy by GLA (%)

1,93 %

Take up (sqm)

2,63K sqm

Investment (#)

4

Investment (€)

10,72M €

Leasing (#)

11

Prime Yield (%)

4,25 %

Prime Rent (€/sqm/month)

235 €

Lease Term (years)

Unlock

Rent Free Period (months)

Unlock

Rental deposit (months)

Unlock

Footfall National vs International (%)

74,47 %

Purchasing Power (€)

16,29K

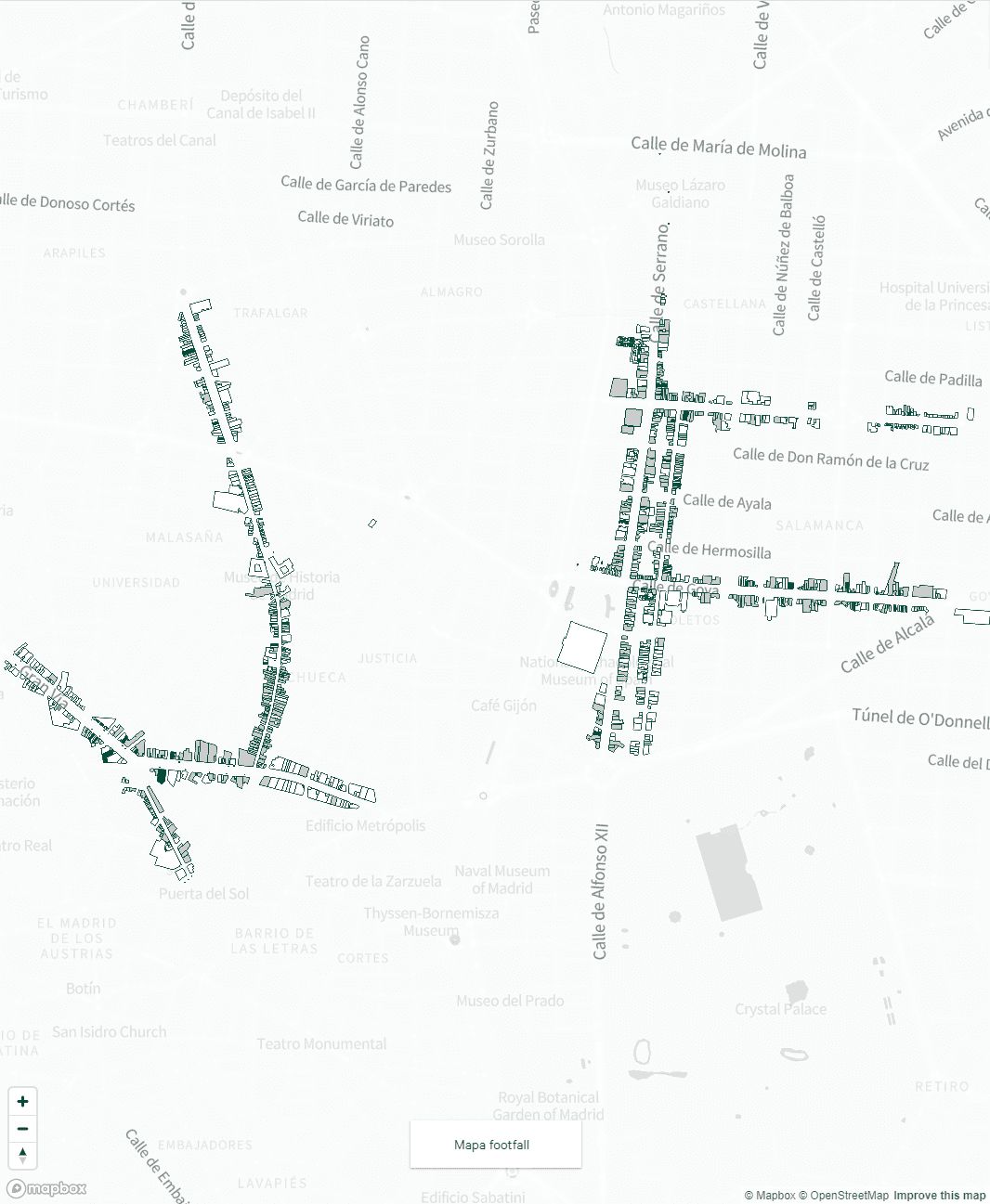

7 Streets

Prime Commercial Properties in Madrid: A Unique Opportunity for Your Business

Madrid boasts the strongest retail structure in Spain, thanks to its large population and high income levels. Additionally, the regional government is the most liberal in the country when it comes to retail development permits and opening hours. The city's prime High Street shopping is divided between two areas in the center. The historic and tourist heart of the city, including Preciados and Gran Vía, offers a wide range of mass-market options. Fuencarral is also part of this area, with small stores from trendy retailers targeting fashion-conscious shoppers. Luxury retail in Madrid is located in the upscale "Barrio de Salamanca" area of the city center. International luxury retailers are particularly drawn to the streets of Serrano and Ortega y Gasset.

Other streets in the area, such as Jorge Juan, Claudio Coello, Ayala, Lagasca, and Hermosilla, form the area known as "El Entresijo" and have also developed a strong retail presence. Many small-sized "premium" retailers have opened stores in the area, while mass-market retailers are primarily located on Calle Serrano and Calle Goya. Within the city, two mixed-use projects have been completed: Plaza Canalejas in the city centre and Caleido in the office area of Madrid. Caleido offers 12,000 sq m of retail space on the ground floor.

Analyzing KPIs for Informed Decision-Making

Prime commercial properties in Madrid present an attractive option for those seeking to establish or expand their business in a privileged location. The Spanish capital is renowned for its vibrant commercial scene and high visitor traffic, making these properties a unique opportunity. However, before deciding on which property is better to rent or buy, it's essential to analyze specific key performance indicators (KPIs).

Vacancy GLA Percentage: Space Occupancy

The Vacancy GLA percentage metric relates to the occupancy rate of prime commercial properties in Madrid. It measures the proportion of available space relative to the total space available for rent or purchase. A low vacancy percentage indicates high occupancy and greater competition for available spaces.

Take Up: The Demand Metric

Take Up is one of the fundamental KPIs for evaluating the prime commercial property market in Madrid. This metric refers to the number of spaces leased or purchased within a specific period. A high Take Up index indicates high demand and a dynamic market. Analyzing this figure allows you to understand the popularity and competitiveness of a particular area.

Investment: Investment Potential

The Investment KPI assesses the potential for investment in prime commercial properties in Madrid. It reflects the interest of investors in acquiring commercial properties in a particular location. A high level of investment may indicate a growing market and a higher potential for profitability.

Leasing: Lease Occupancy

The leasing KPI refers to the number of prime commercial properties in Madrid that are currently leased compared to those available for lease. This indicator provides insights into the demand and occupancy of properties in the market. A high leasing index can indicate an active and competitive market, while a low index may suggest lower demand or limited availability of properties in the desired location.

Prime Yield: Return on Investment

Prime Yield is a metric that evaluates the return on investment in prime commercial properties in Madrid. It refers to the expected percentage of return on the investment made in a commercial property. A high Prime Yield indicates a greater potential for profits and returns for investors.

Prime Rent: The Value of Space

Prime Rent refers to the average rental price per square meter in a prime location. This indicator is essential for determining the profitability and potential return on investment of a commercial property in Madrid. A high Prime Rent indicates a premium location with strong appeal for businesses. However, it's important to balance the value of the space with your budget and projected business income.

Visitor Type: Know Your Audience

Each prime commercial property in Madrid attracts a specific type of visitor. Understanding the audience profile frequenting the area where the property you're considering is located is crucial. Is it a tourist, residential, or business area? Does it target a young audience, families, or professionals? By understanding the visitor type drawn to the location, you can better align your business with the needs and preferences of your target audience.

Lease Terms (Years)

Lease terms refer to the duration of the lease agreement for prime commercial properties in Madrid, typically measured in years. It is important to consider lease terms that align with your long-term business needs and provide stability in your chosen location.

Rent Free Period (Months)

The rent free period is another significant KPI to consider when evaluating prime commercial properties in Madrid. It represents the period of time during which the tenant is not required to pay rent. This period can be strategically used to establish and settle the business before starting rent payments. Evaluating this KPI will help you better plan your cash flow and adjust your budget accordingly.

Rental Deposit (Months)

The rental deposit is the monetary amount that the tenant must pay to the property owner or property manager. This deposit is usually measured in months of rent and acts as a guarantee to cover any damages or lease violations. Evaluating the rental deposit will help you understand the initial costs associated with the commercial property and its impact on your budget.

Footfall National vs International (%)

The footfall national vs international KPI measures the proportion of national and international visitors frequenting a particular area or shopping center in Madrid. This indicator is relevant for understanding the reach and market potential of your business. Depending on your target audience and the nature of your business, it is important to evaluate the percentage of visitors that come from the national and international realms.

Purchasing Power: Poder Adquisitivo

Purchasing Power is an important KPI to consider when analyzing prime commercial properties in Madrid. It refers to the economic capacity of the local population or visitors in the area. A high Purchasing Power indicates that consumers have the financial resources to spend on products or services, which can positively influence the performance of your business. It's essential to evaluate the purchasing power of your target audience to ensure that your offerings align with their buying capacity.

What are you looking for?

Availability

Area

Streets

Order by

No properties match the filters